The United States is experiencing a rebound in manufacturing that increasingly strains and tests traditional supply chains. As a result, U.S. manufacturers are rethinking how they manage risks associated with supply chains. The development of new strategies has yielded a variety of solutions to the challenge. The broad spectrum of plans revealed to date ranges from reshoring production to regionalizing production to match regional demand. The USMTO numbers show that industries that moved almost entirely offshore are now spending multiples of prior years’ investment levels to develop domestic capacity. Those industries include key components, such as molds, dies, and valve industries. Still, the impetus to implement these plans is the increasing demand for U.S.-manufactured products. That growth has exceeded expectations in most industries, but the outstanding element of this recovery has been its breadth. At this time, only the contract manufacturing sector represents more than 20% of the manufacturing technology ordered monthly, whereas in 2019, the top three customer industries represented more than 70%.

Past recoveries

In past manufacturing technology recoveries, each technology would one by one see upticks in order activity. Typically, consumables lead recoveries, as more activity on the shop floor leads to greater demand for consumables. Then orders for production equipment rise as capacity utilization expands. However, this hasn’t been the case in this recovery. Production equipment led the recovery, and tooling shipments are just beginning to expand. In part, the reason for the role reversal is the quirks with supply chain issues, particularly supplies of steel and other metals and inventory of manufacturing technology products. Still, no one doubts that U.S. manufacturing is well along the way to recovery. We can count ourselves among the lucky ones.

While there are nations that have rebounded faster and stronger than U.S. manufacturing, those that did better are fewer than those still struggling. Individual nations’ abilities to address supply chain issues and the pandemic, as well as their reliance level on trade and the importance of manufacturing to their economy, have created uneven economic and manufacturing recoveries in 2021.

Mexico

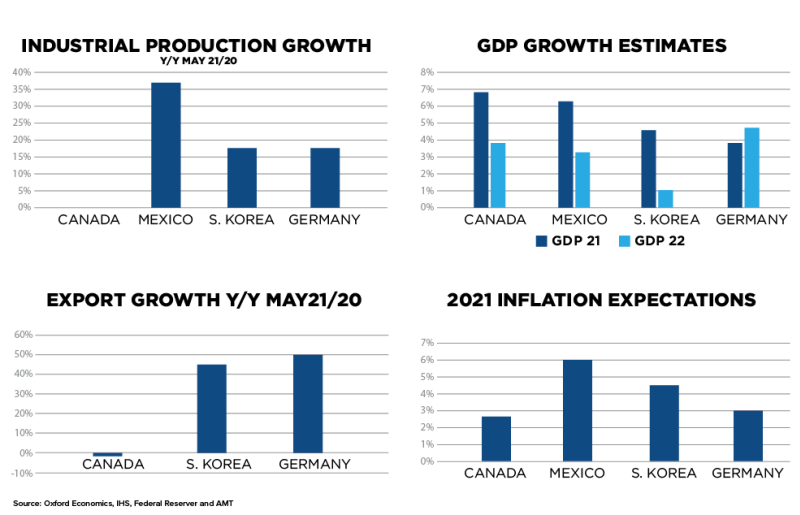

Here in North America, Mexico and Canada have done well. Mexico still struggles with the pandemic, but the manufacturing sector has taken off. Higher oil prices have quickly helped the government take strong fiscal actions while keeping a balanced budget, at least through May of this year. The impact on manufacturing is significant. Manufacturing represents 75% of all exports, and total exports jumped 49% in the second quarter of 2021 relative to 2020. Industrial production is up 37% between May 2020 and 2021. Expectations are that Mexico will see a 6.2% increase in GDP in 2021 and another 3.2% in 2022, while inflation will increase 6% in 2021. The facts (or stats) paint a pretty strong picture for our southern USMCA partner.

Canada

The expectations are that Canada will see a big jump in GDP this summer that will lead to a 6.8% year-over-year growth rate, which is even more impressive when you consider that Canada’s 2020 GDP only fell 5.3% compared to Mexico’s 11.4% drop. Manufacturing has not done as well. Industrial production and exports have not rebounded yet. May exports are off 1.6% from 2020, and May’s industrial production index is basically unchanged from last year. Many believe that Canada is a resource-based economy, but manufacturing represents 40.9% of total exports and 9.5% of Canadian GDP. The main durable manufacturing sector is the automobile industry, which has been plagued by the supply chain challenges in materials and semiconductors. The substantial but smaller manufacturing footprint in Canada’s economy versus Mexico and the United States was just enough to slow Canada’s manufacturing recovery.

The graphs here represent the statistics cited above on Canada and Mexico, as well as Germany and South Korea, and provide a perspective that economic growth does not necessarily mean investment growth in the manufacturing sector. A full recovery means the economy and manufacturing are both expanding. The global market isn’t quite there yet, but we are headed in the right direction.

If you have any questions about the information above or want similar information on manufacturing in other countries, please contact me at pmcgibbon@��ɫ��Ƶonline.org